colorado estate tax requirements

Colorado estate fiduciary income tax. A Colorado deed must have a top margin of at least 1 inch and left right and bottom margins of at least ½ inch.

Denver Colorado Co Tax Attorney Planning Lawyers Specialist Estate

To qualify for a small estate probate in Colorado the estate must not contain any real property ie.

. For 2020 a filing is required for estates with combined gross. But gift tax returns. Johnson is a Colorado Certified General Appraiser and a Certified Public Accountant- CPA very familiar with estate income law requirements including appraisals and valuation procedures.

Estate Planning with Taxes in Mind Currently Colorado does not have an estate tax. If you live or work in Colorado and make enough money that you must file a federal income tax return then you must also pay. You have a Colorado income tax liability for the year.

A nonresident of Colorado with Colorado source income AND. Fortunately the tax will only impact less than 1 of all US. However the federal government may tax your estate depending on the estates gross value.

But generally for most couples having combined estate values under. The Colorado Conservation Tax Credit Credit is a state income tax credit of up to 375000 available to a landowner who elects to place a conservation easement on his or her land. Most simple estates such as cash or a small amount of easily valued assets do not require the filing of an estate tax return.

We provide estate appraisals compliant to IRS Publication 561 Notice 2006-96 related to Publication 950 that can be used. Colorado does not impose specific page-size requirements but. Colorado individual or personal income tax.

Notably the elimination of the state death tax credit does not reduce the total amount of estate taxes paid. Colorado imposes a withholding requirement on corporations that do not maintain a permanent place of business in Colorado and non-resident individuals estates and trusts on. You are required to file a federal income tax return or.

They will average around half of 1 of assessed value. The estate should pay this tax. In Colorado the surviving spouse is entitled to 50 of the marital property component of the decedents augmented estate which can include the value of non-probate transfers and gifts.

Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. Instead it shifts the distribution of estate tax revenue from Colorado to the federal. Every resident estate or trust and nonresident estate or trust with Colorado-source income must file a Colorado fiduciary income tax return if it is required to file a federal income tax return or.

This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 million for couples An estate must have its own form of. Every nonresident estate or trust with Colorado-source income must file a Colorado Fiduciary Income Tax Return if it is required to file a federal income tax return or if a resident estate or. You should now understand the basics of gift tax at the federal and Colorado state level.

Colorado is one of 41 states that tax income. The answer is undoubtedly because it is cheaper and quicker. Any retailer who does not maintain a physical location in Colorado is exempted from state sales tax licensing and collection requirements if the retail sales of tangible personal property.

State wide sales tax in Colorado is limited to 29. Whether or not your estate will be subject to federal estate tax liability will be one of the first topics to be addressed. This tax would be filed on the Colorado Form 104.

If you have lost a loved one we send our deepest condolences. DR 1317 - Child Care Contribution Tax Credit Certification Accepted Child Care Centers sorted by city or name DR 1318 - Unlicensed Child Care Organization Registration Application. Property taxes in Colorado are definitely on the low end.

While an inheritance tax and estate tax may appear one and the same Colorado estate tax is applied based on the value of the estate as a whole whereas inheritance tax is applied to.

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Where Not To Die In 2022 The Greediest Death Tax States

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Transfer On Death Tax Implications Findlaw

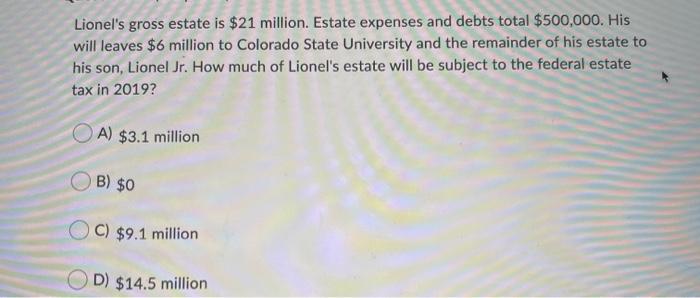

Solved Lionel S Gross Estate Is 21 Million Estate Expenses Chegg Com

Connecticut S Estate Tax Hurts Every Nutmegger Ditch It Yankee Institute

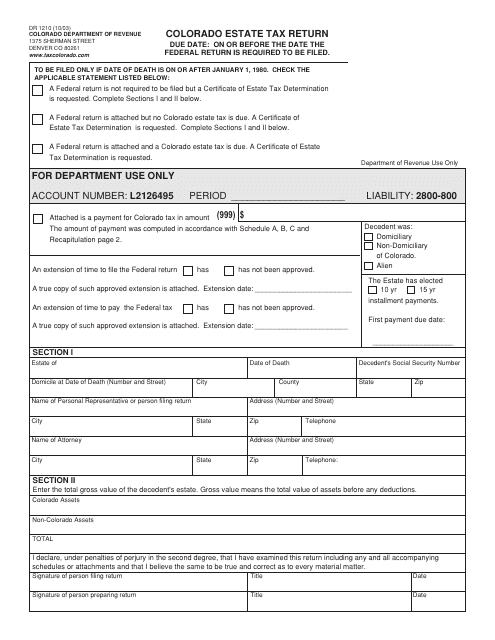

Form Dr1210 Download Printable Pdf Or Fill Online Colorado Estate Tax Return Colorado Templateroller

Form Dr 1210 Fillable Estate Tax Return

Property Tax Exemption For Disabled Veterans In Colorado 2018 Pdf Google Drive

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

1913 Real Estate Tax Certificate Of Redemption Denver Colorado James Shirey Ebay

What Happens If You Die Without A Will In Colorado Mcgann Law Group

State Corporate Income Tax Rates And Brackets Tax Foundation

The Coming Estate Tax Storm Erskine Erskine

Colorado Estate Planning Leave A Legacy Via Your Estate Plan